39 treasury bill coupon rate

The Fed - Commercial Paper Rates and Outstanding Summary Data as of June 17, 2022 Posted June 21, 2022. The commercial paper release will usually be posted daily at 1:00 p.m. However, the Federal Reserve Board makes no guarantee regarding the timing of the daily posting. This policy is subject to change at any time without notice. US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.202% Yield Day High 3.258% Yield Day Low 3.172% Yield Prev Close 3.194% Price 97.1094 Price Change -0.2031 Price Change % -0.2109% Price Prev Close 97.3125 Price Day High 97.50 Price...

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate

Treasury bill coupon rate

EGP T-Bills EGP Treasury Bill Auction According to the Primary Dealers System. Type (days) 182. 364. 91. 273. Auction date. 23/06/2022. 23/06/2022. 2 Year Treasury Note Rate Constant Maturity - Bankrate Two-Year Treasury Constant Maturity. 3.21. 2.53. 0.25. What it means: An index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to ... Zambia Government Bonds - Yields Curve The Zambia 10Y Government Bond has a 25.510% yield. Central Bank Rate is 9.00% (last modification in February 2022). The Zambia credit rating is SD, according to Standard & Poor's agency.

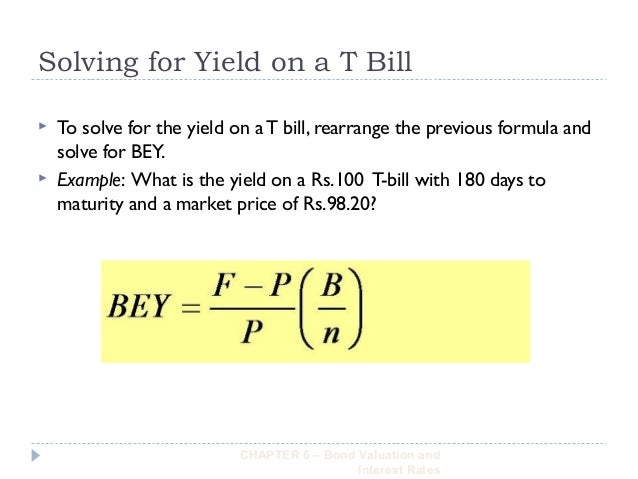

Treasury bill coupon rate. India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Bootstrapping in Excel a Yield Curve to perfectly fit Bloomberg Price ... The Yield-To-Maturity (y) is defined through the following formula: P(1 + yt) = 100. where P is the bill's purchase price and t is the time from settlement to maturity in annual units calculated according to the ISMA and US Treasury convention, also known as Actual/Actual Bond and Actual/Actual ISMA.. The reason behind adopting this daycount convention is because one prefers that it is the ... India Government Bonds - Yields Curve Central Bank Rate is 4.90% (last modification in June 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%. 5-Year T-Note Overview - CME Group Time & Sales. Specs. Margins. Calendar. 5-Year US Treasury futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading.

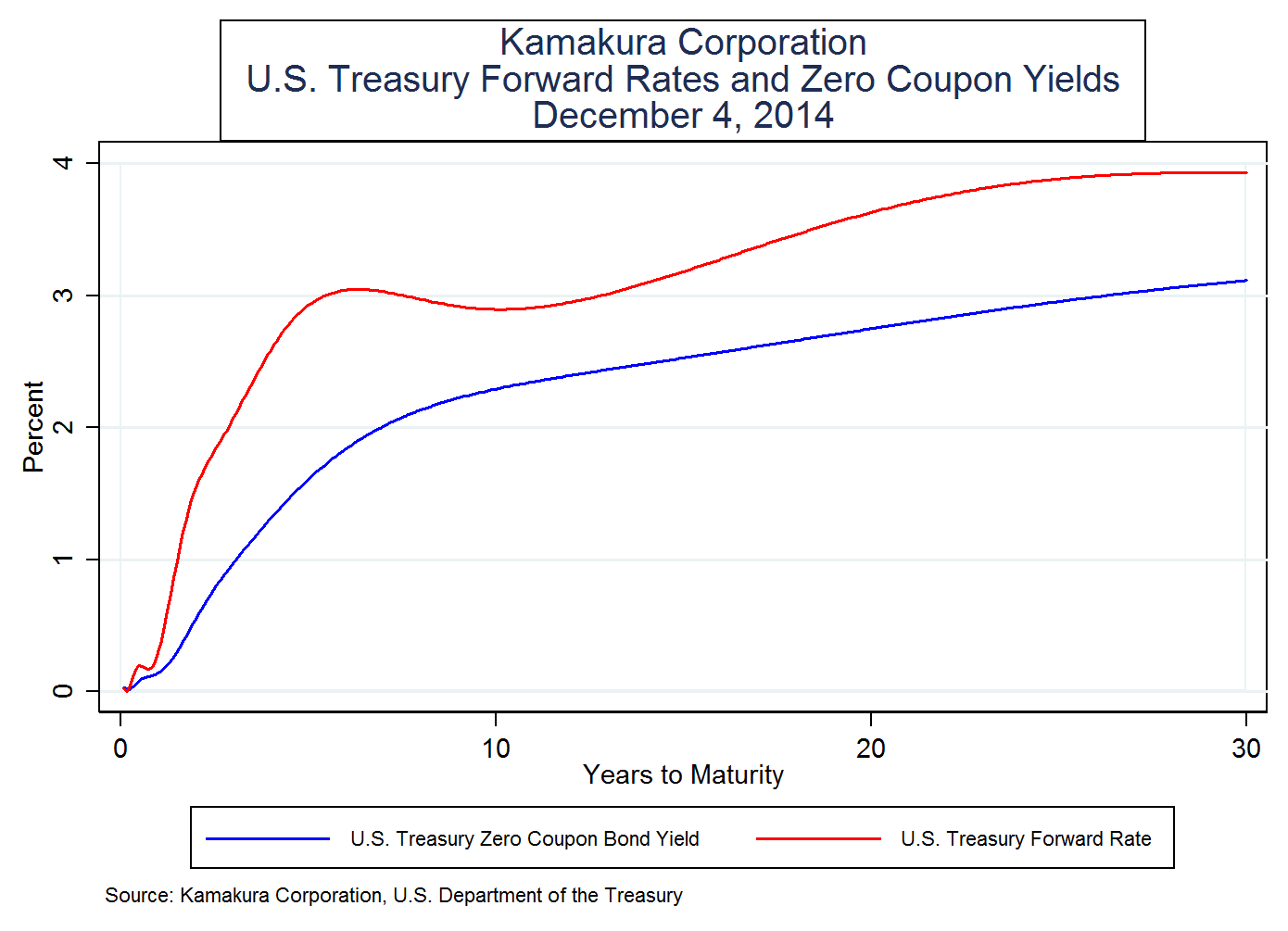

BIL: SPDR® Bloomberg 1-3 Month T-Bill ETF - SSGA The SPDR ® Bloomberg 1-3 Month T-Bill ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg 1-3 Month U.S. Treasury Bill Index (the "Index"); Seeks to provide exposure to zero coupon U.S. Treasury securities that have a remaining maturity of 1-3 months; Short duration fixed income is less exposed to ... Rising Interest Rates Will Crush the Federal Budget - WSJ The current yield on five-year Treasury notes is about 3.25%—1.5 points higher than the high end of the fed-funds-rate range. If these maturing Treasury notes roll over at the same spread over ... Investing in Treasury Bills: The Safest Investment in 2022? Secondly, as per the U.S. Treasury website, the highest interest rate on a T-bill is around 0.10%. Either way you slice it, you are not going to be living in retirement off of Treasury bills. However, for the longer-term T-notes and T-bonds, interest is paid every six months. Daily Treasury Yield Curve Rates - YCharts Daily Treasury Yield Curve Rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the ...

20 Year Treasury Rate - multpl.com 20 Year Treasury Rate chart, historic, and current data. Current 20 Year Treasury Rate is 3.38%, a change of -8.00 bps from previous market close. EGP T-Bonds Monthly Average Interest Rates; EGP T-Bills Secondary Market; Time Series; Cairo Overnight Index Average - CONIA; Auctions Currently selected. Treasury Auctions T-Bills. EGP T-Bills; USD T-Bills; ... EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 5: Auction date: 27/06/2022: Issue date: 28/06/2022 ... U.S. 3 Month Treasury Bill Overview (TMUBMUSD03M) | Barron's U.S. 3 Month Treasury Bill Tullett Prebon Watchlist N/A TMUBMUSD03M Real Time Quote Key Data Open1.672% Day Range1.623 - 1.685 52 Wk Range0.020 - 1.810 Price1 20/32 Change0/32 Change Percent-0.61%... Government bond - Wikipedia It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date. For example, a bondholder invests $20,000 (called face value) into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% of the $20,000 each year.

United States Rates & Bonds - Bloomberg.com

The Fed - H.15 - Selected Interest Rates (Daily) - June 28, 2022 The 30-year Treasury constant maturity series was discontinued on February 18, 2002, and reintroduced on February 9, 2006. From February 18, 2002, to February 9, 2006, the U.S. Treasury published a factor for adjusting the daily nominal 20-year constant maturity in order to estimate a 30-year nominal rate.

U.S. Treasury Blocks Over $1 Billion in Suleiman Kerimov Trust Enforcement investigation unearthed oligarch's use of a network of relatives, advisers, and opaque legal entities to invest in the United States WASHINGTON - Today, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) announced it has issued a Notification of Blocked Property to Heritage Trust, a Delaware-based trust in which OFAC-designated Russian oligarch ...

10-Year T-Note Overview - CME Group Futures and Options. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading ...

Treasury Rates, Interest Rates, Yields - Barchart.com This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least ...

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. ... Categories > Money, Banking, & Finance > Interest Rates > Treasury Constant Maturity. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis ...

Yield Basis Definition - Investopedia The $1,000 par bond is trading at a dollar value of 940. The yield basis can be calculated using the current yield formula presented as: Coupon / Purchase Price Following our example above, the...

Features and Advantages of Treasury Bills | Invest in T-Bills For an instance- 91 day T-bill with a face value of ₹100 can be issued to the individual at the discounted rate of ₹98.20. During the T-bill maturity, the individual will receive the complete face value of ₹100 thus the profit of ₹1.60 is gained. Features & Advantages of T-Bills Features:

Current Rates | Edward Jones Rates effective as of June 16, 2022 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate. Our Personal Line of Credit is a margin loan and is available only on certain types of accounts.

2 Year Treasury Rate - YCharts The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 2.92%, compared to 3.06% the previous market day and 0.25% last year.

Treasury Bonds Rates - WealthTrust Securities Limited Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 (discount). While offering higher return than other fixed income investments, T-Bond investments can be liquidated instantly by way of the secondary market.

Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Zambia Government Bonds - Yields Curve The Zambia 10Y Government Bond has a 25.510% yield. Central Bank Rate is 9.00% (last modification in February 2022). The Zambia credit rating is SD, according to Standard & Poor's agency.

2 Year Treasury Note Rate Constant Maturity - Bankrate Two-Year Treasury Constant Maturity. 3.21. 2.53. 0.25. What it means: An index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to ...

EGP T-Bills EGP Treasury Bill Auction According to the Primary Dealers System. Type (days) 182. 364. 91. 273. Auction date. 23/06/2022. 23/06/2022.

Post a Comment for "39 treasury bill coupon rate"