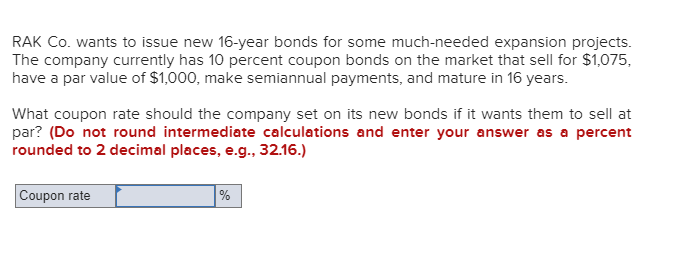

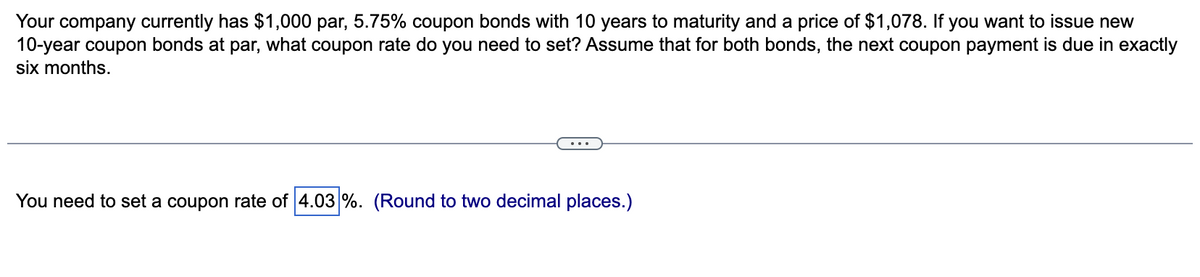

42 what coupon rate should the company set on its new bonds if it wants them to sell at par

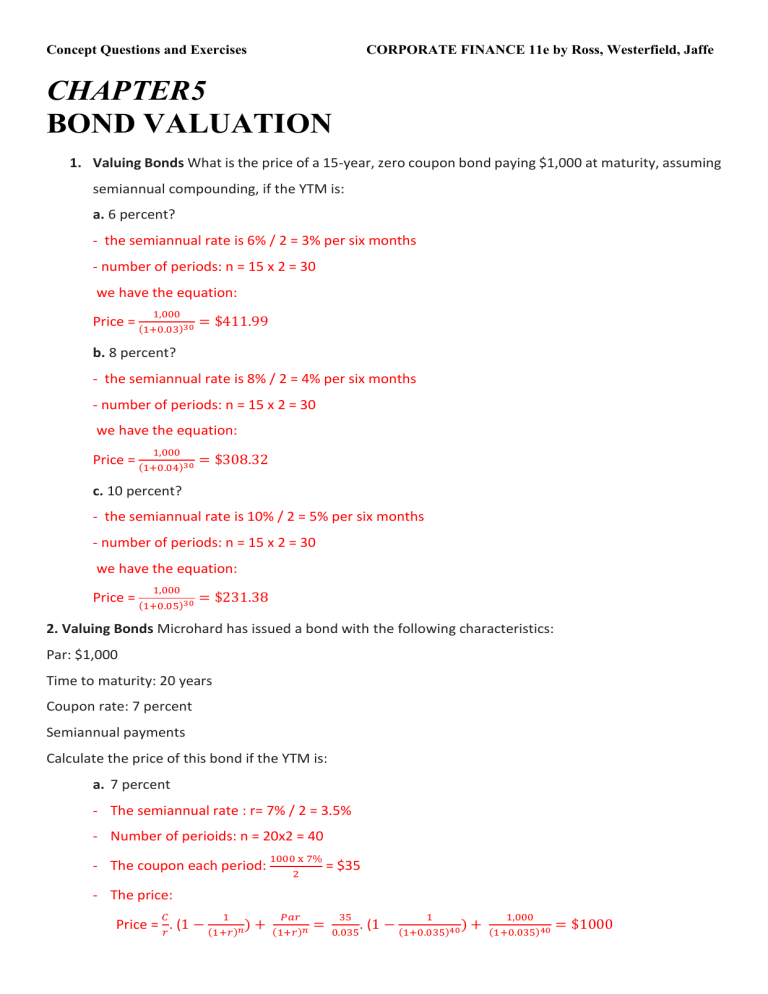

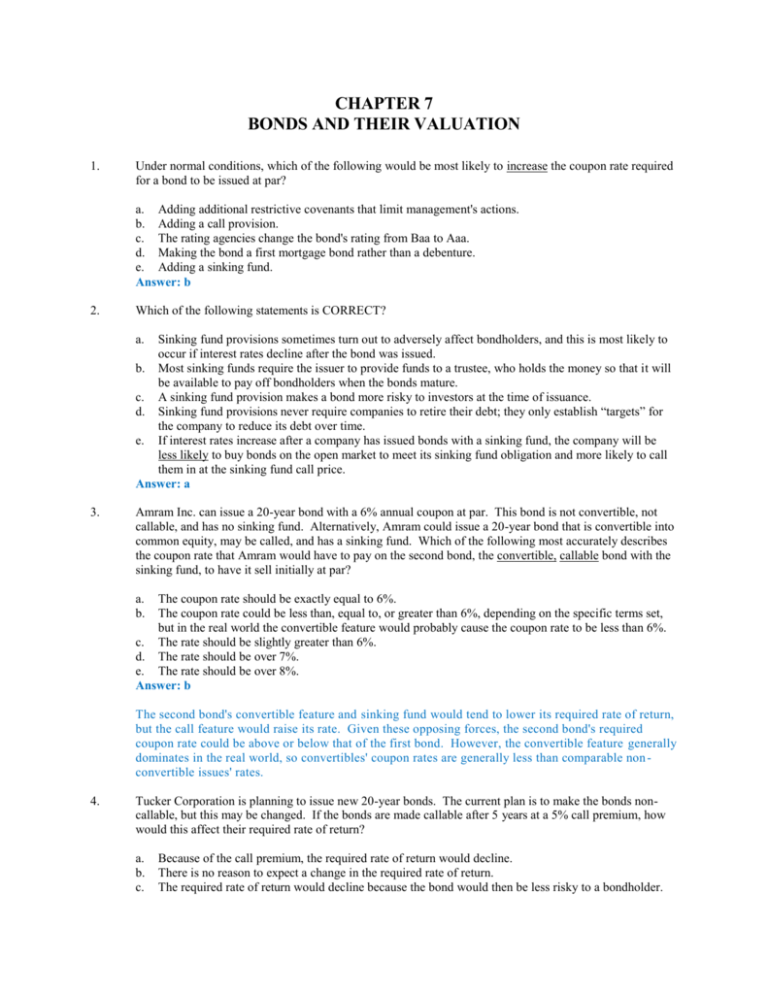

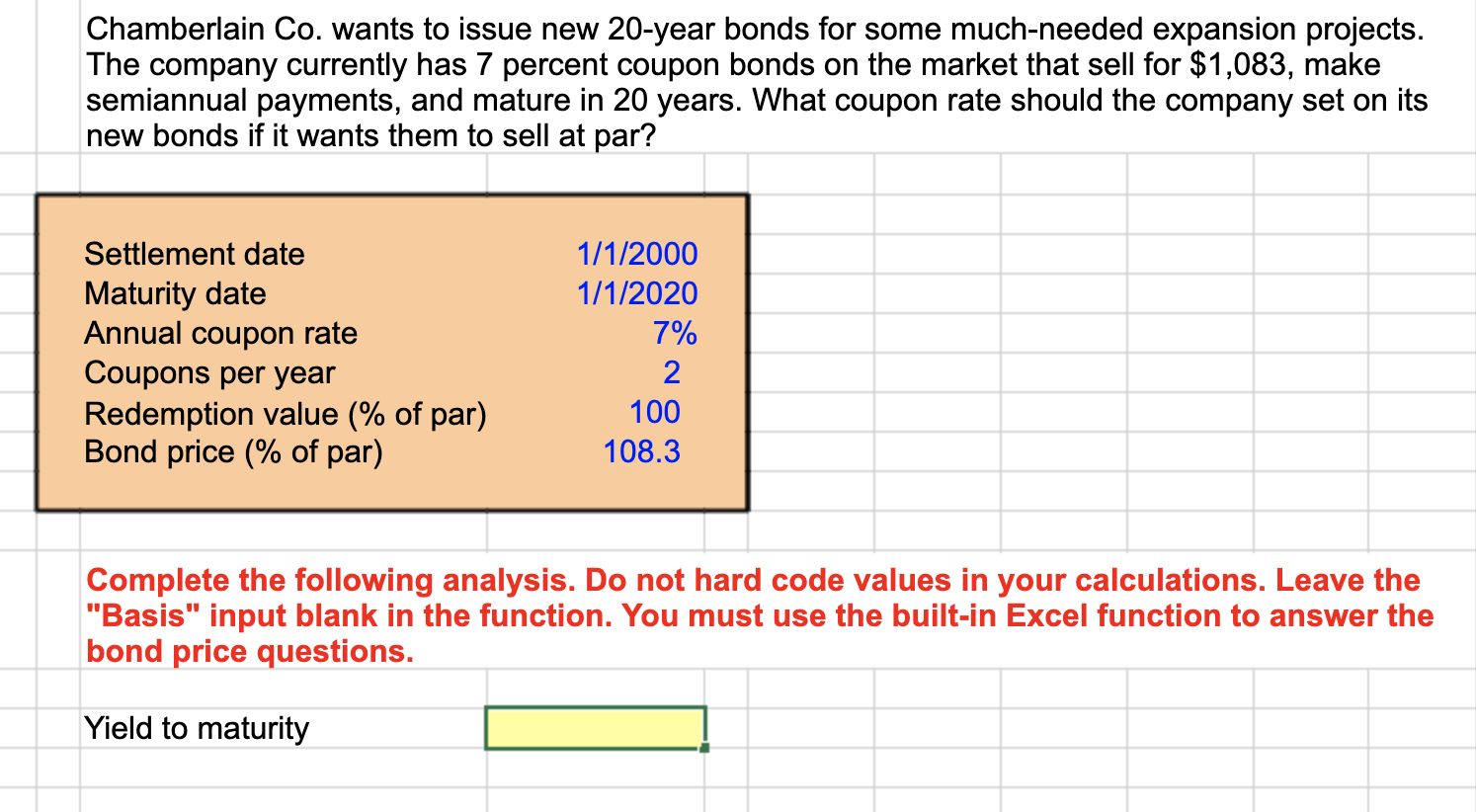

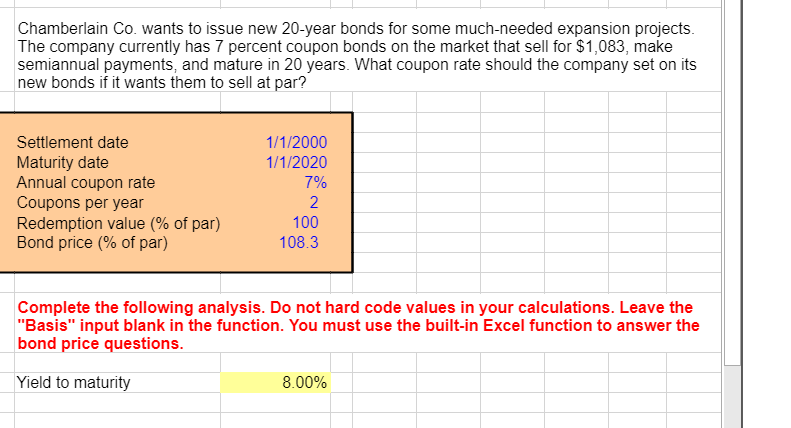

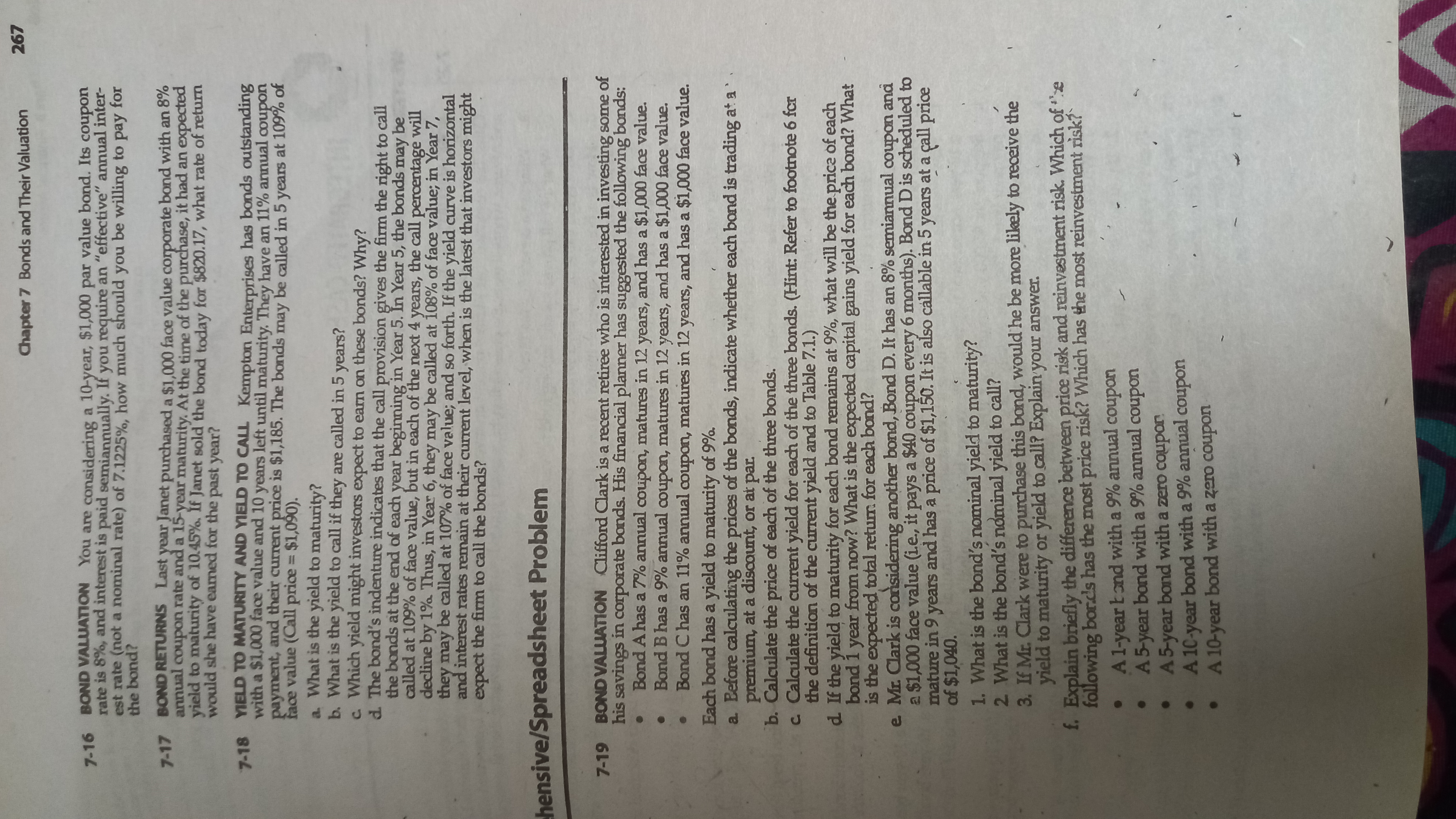

Solved BDJ Co. wants to issue new 25-year bonds for some | Chegg.com See Answer. BDJ Co. wants to issue new 25-year bonds for some much-needed expansion projects. The company currently has 4.8 percent coupon bonds on the market that sell for $1,028, make semiannual payments, have a $1,000 par value, and mature in 25 years. Chamberlain Co. wants to issue new 20-year bonds for some mu | Quizlet Question. Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

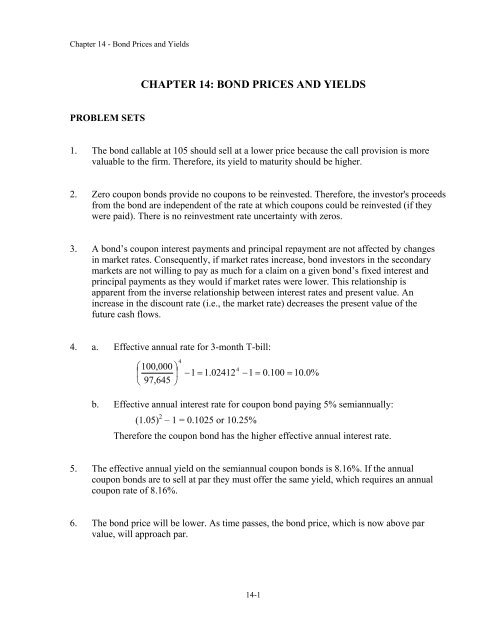

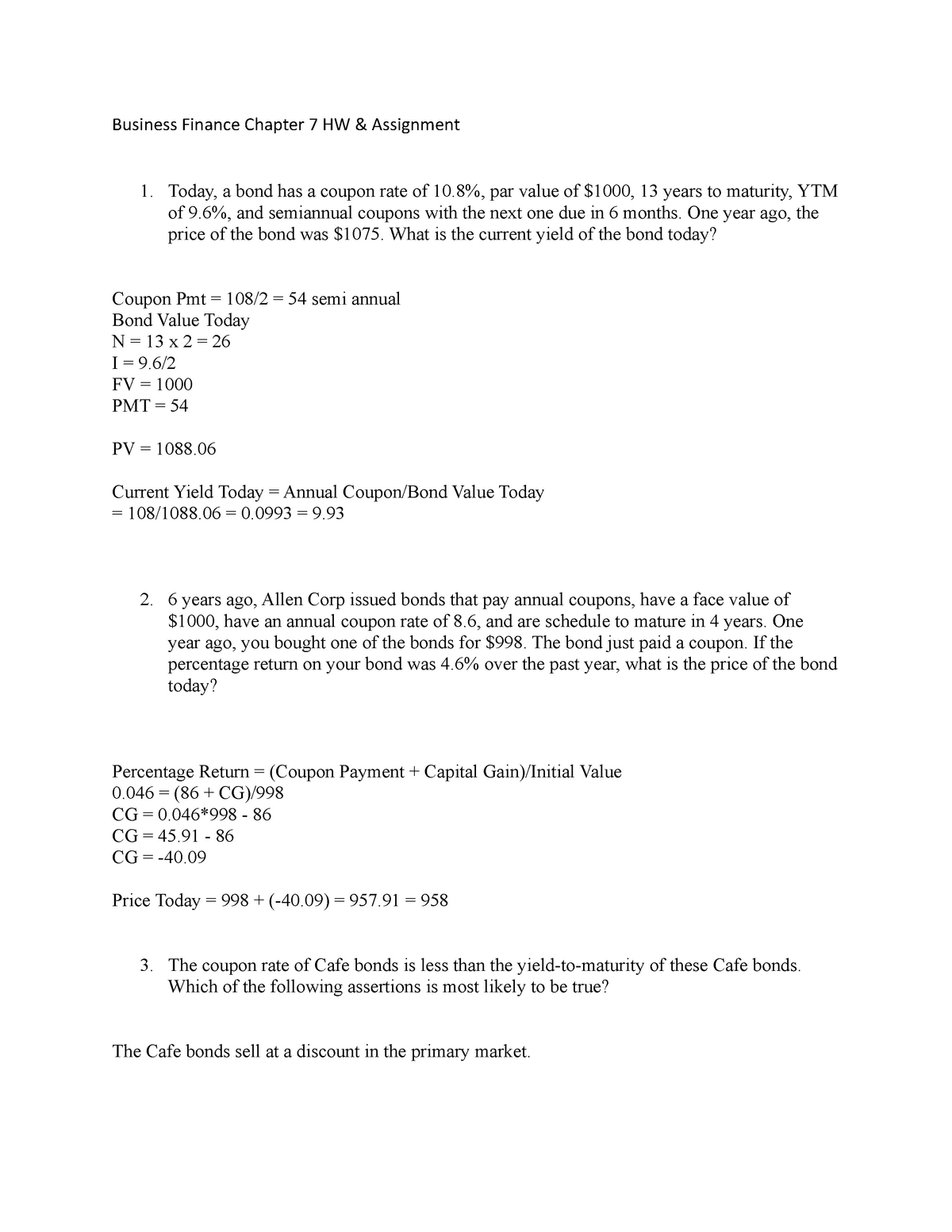

What coupon rate should the company set on its new bonds if it wants ... 1 Answer to Bond Yields BDJ Co. wants to issue new 10-year bonds for some muchneeded expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants...

What coupon rate should the company set on its new bonds if it wants them to sell at par

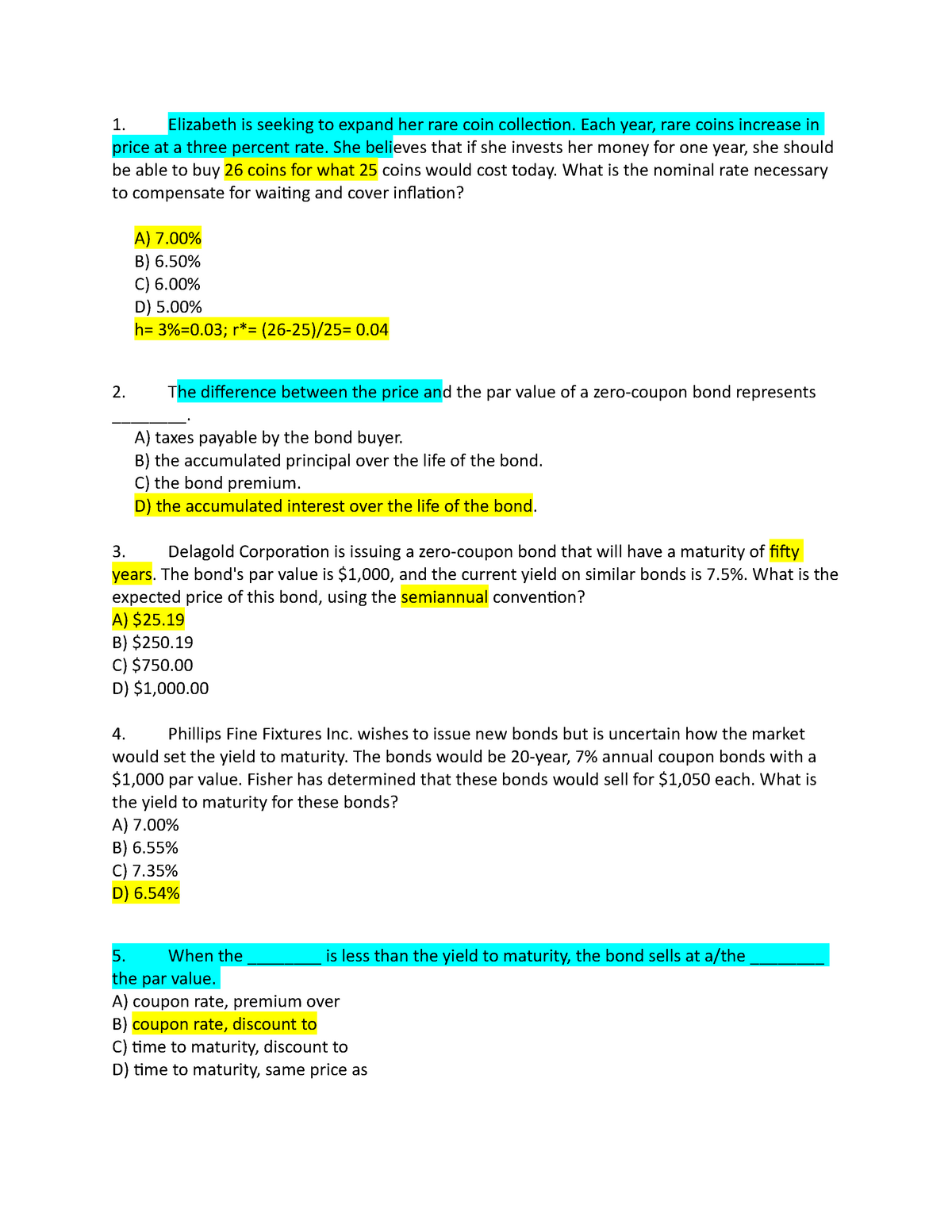

Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Union Local School District has bonds outstanding with a coupon rate of 3.3 percent paid semiannually and 20 years to maturity. The yield to maturity on these bonds is 3.7 percent and the bonds have a par value of $10,000. What is the price of the bonds? (Do not round intermediate calculations and round your answer to 2 decimal ... Sports News & Articles – Scores, Pictures, Videos - ABC News WebNEWARK, N.J. -- As the New Jersey Devils celebrated their franchise record-tying 13th consecutive victory Monday night, a sold-out home crowd rose to its feet to commemorate the moment. "I think ... Solved Uliana Company wants to issue new 21-year bonds for | Chegg.com See Answer. Uliana Company wants to issue new 21-year bonds for some much-needed expansion projects. The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to ...

What coupon rate should the company set on its new bonds if it wants them to sell at par. Solved Uliana Company wants to issue new 18-year bonds for - Chegg The company currently has 9 percent coupon bonds on the market that sell for $1,045, have a par value of $1,000, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Question: Uliana Company wants to issue new 18-year bonds for some much-needed expansion ... What Coupon Rate Should The Company Set On Its New Bonds If It Wants ... A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. The bonds make semiannual payments and currently sell for 104 percent of par. Answer in Finance for rim #9185 - Assignment Expert Answer to Question #9185 in Finance for rim. LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to ... Achiever Papers - We help students improve their academic … WebWe do not take the issue of plagiarism rightly. As a company we try as much as possible to ensure all orders are plagiarism free. All our papers are written from scratch thus producing 100% original work. We also have a plagiarism detection system where all our papers are scanned before being delivered to clients.

Press Releases | U.S. Department of the Treasury WebDaily Treasury Par Real Yield Curve Rates. Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. ... Treasury Sanctions Illicit Fentanyl-Trafficking La Nueva Familia Michoacana and its … Solved What coupon rate should the company set on its new | Chegg.com Calculation of The YTM of the Bond: Given: Face Value (FV) = $1000 Current Market Value (MV) = $1125 Coupon rate = 5.8% or 0.058 No. of years = 10 years Coupon payment frequency in a year = 2 times Interest compounding frequency in a year = 2 times B… View the full answer Solved Uliana Company wants to issue new 15-year bonds for - Chegg What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and; Question: Uliana Company wants to issue new 15-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,070, make semiannual payments ... Fortune - Fortune 500 Daily & Breaking Business News | Fortune Finance If you think the world’s energy crisis is bad right now, next winter will be worse, says the OECD, whose new global outlook predicts bad times ahead BY Vivienne Walt November 22, 2022

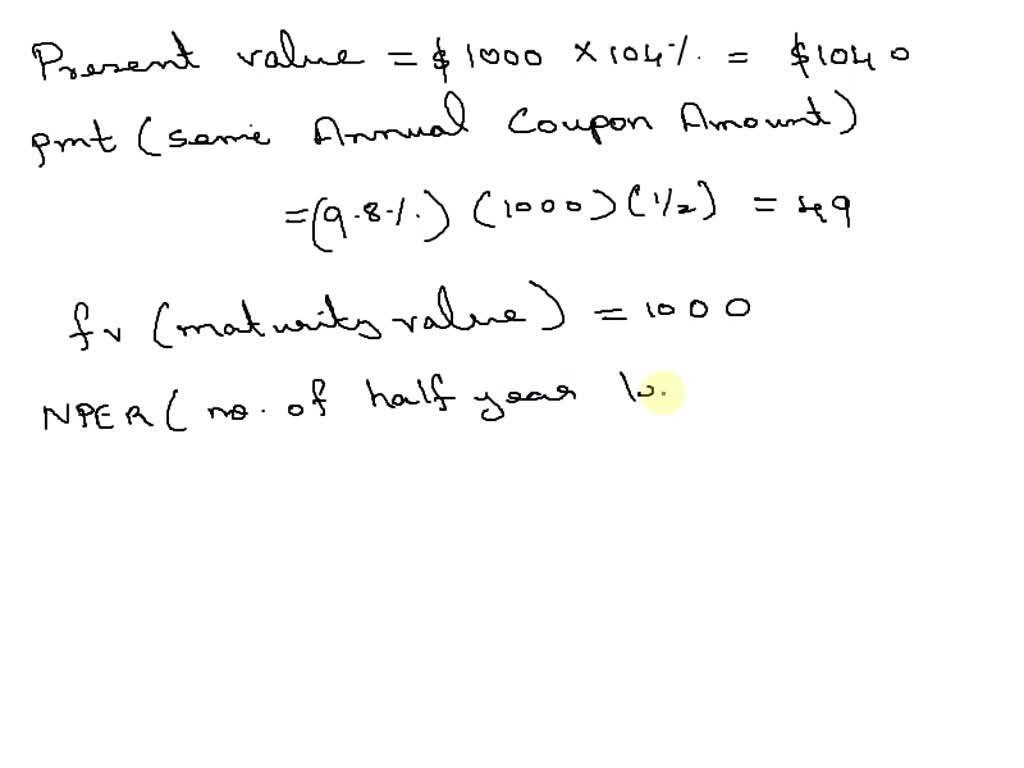

Bond Yields: Uliana Co. wants to issue new 20-year bonds for some much ... The company currently has 6% coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par Literotica.com - Members - SZENSEI - Submissions Web08/03/2017 · Job hunting Erin makes a new... pet. BEST TAIL she ever had. Erotic Horror 08/21/22: Eyes Up Here Ch. 01: SIGHTS SET (4.60) MASTER or MAsTEr. The Boss is still the Boss. Mind Control 01/06/20: Far Pangaea: 96 Part Series: Far Pangaea 01 : Time Trial (4.57) Now you see them. Now you Won't. Ever again. Maybe. Sci-Fi & Fantasy 07/06/17 Practice 7.b (YTM) Flashcards | Quizlet Chamberlain Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,045, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Unbanked American households hit record low numbers in 2021 Web25/10/2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

Coupon Rate the Company Should Set on Its New Bonds - BrainMass A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at.

7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet The company currently has 11.6 percent coupon semiannual payments, and mature in 14 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Will be on exam. If Connor Co. wants the bonds to sell at par, they should set the coupon rate equal to the required return.

FNCE 3101 PS3. Rates and Bonds Valuation Flashcards | Quizlet Coronel Corporation wants to issue new 20-year bonds. The company currently has 8.5 percent bonds on the market that sell for $994, make semiannual payments, and mature in seven years. What should the coupon rate be on the new bonds if the firm wants to sell them at par? a. 8.62% b. 8.87% c. 8.75% d. 9.23% e. 8.41%

Entertainment & Arts - Los Angeles Times WebCantor’s famously long goal call has become his calling card. But the Telemundo star, now covering his 12th World Cup, is a true student of the game.

Interest rate - Wikipedia WebA company borrows capital from a bank to buy assets for its business. In return, the bank charges the company interest. ... coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, ... In July 2009, Sweden's central bank, the Riksbank, set its policy repo rate, the interest rate on its one-week ...

Latest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

Solved Uliana Company wants to issue new 20-year bonds for - Chegg Expert Answer. Transcribed image text: Uliana Company wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds ...

Could Call of Duty doom the Activision Blizzard deal? - Protocol Web14/10/2022 · In other words, if Microsoft owned Call of Duty and other Activision franchises, the CMA argues the company could use those products to siphon away PlayStation owners to the Xbox ecosystem by making them available on Game Pass, which at $10 to $15 a month can be more attractive than paying $60 to $70 to own a game outright.

What coupon rate should the company set on its new bonds if it wants ... What coupon rate should the company set on its new bonds if it wants them to from FINA 6320 at University of Texas, Permian Basin. Study Resources. Main Menu; by School; by Literature Title; ... What coupon rate should the company set on its new. School University of Texas, Permian Basin; Course Title FINA 6320;

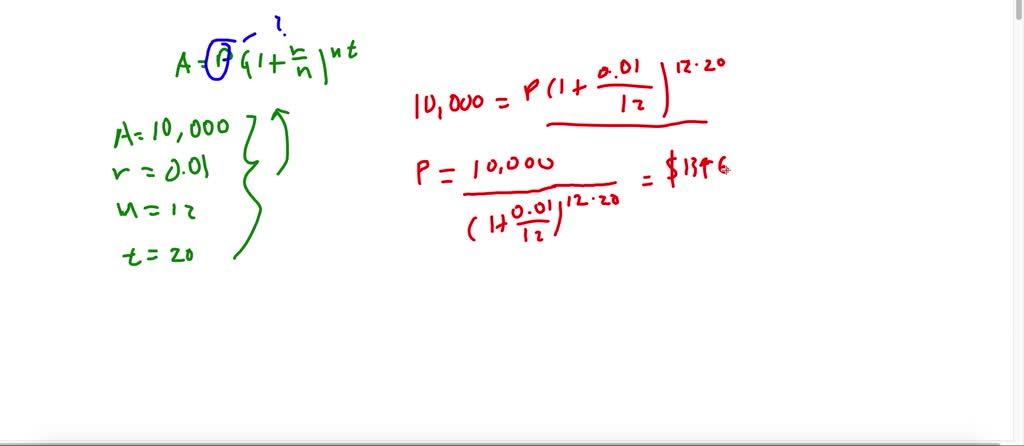

Involve zero-coupon bonds. A zero-coupon bond is a bond that is sold now at a discount and will pay its face value at the time when it matures; no interest payments are made. A zero-coupon bond can be ...

North County - The San Diego Union-Tribune Web16/11/2022 · News from San Diego's North County, covering Oceanside, Escondido, Encinitas, Vista, San Marcos, Solana Beach, Del Mar and Fallbrook.

Solved Uliana Company wants to issue new 21-year bonds for | Chegg.com See Answer. Uliana Company wants to issue new 21-year bonds for some much-needed expansion projects. The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to ...

Chamberlain Co. wants to issue new 16-year bonds for some, much-needed expansion projects. The company currently has 12.0, percent coupon bonds on the market that sell for 1,403.43, make, semiannual ...

Sports News & Articles – Scores, Pictures, Videos - ABC News WebNEWARK, N.J. -- As the New Jersey Devils celebrated their franchise record-tying 13th consecutive victory Monday night, a sold-out home crowd rose to its feet to commemorate the moment. "I think ...

Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Union Local School District has bonds outstanding with a coupon rate of 3.3 percent paid semiannually and 20 years to maturity. The yield to maturity on these bonds is 3.7 percent and the bonds have a par value of $10,000. What is the price of the bonds? (Do not round intermediate calculations and round your answer to 2 decimal ...

![Answered: 22. Bond Yields [LO2] Chamberlain Co.… | bartleby](https://content.bartleby.com/qna-images/question/008cf799-b2df-467b-ba48-3247e8c37d8e/f5990102-496c-4003-ab93-17975daef766/jlmvts6_processed.png)

Post a Comment for "42 what coupon rate should the company set on its new bonds if it wants them to sell at par"