43 what is the coupon rate of a bond

Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. Coupon Rate Formula | Step by Step Calculation (with Examples) The par value of the bond is $1,000, and it is trading $950 in the market. Determine which statement is correct: Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100

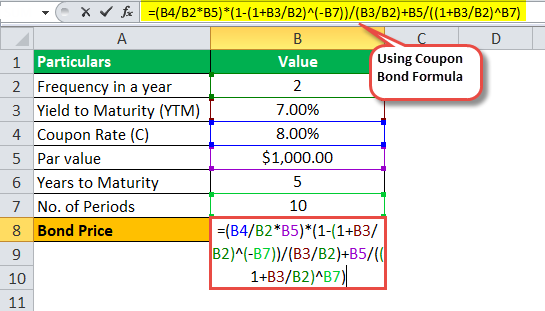

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

What is the coupon rate of a bond

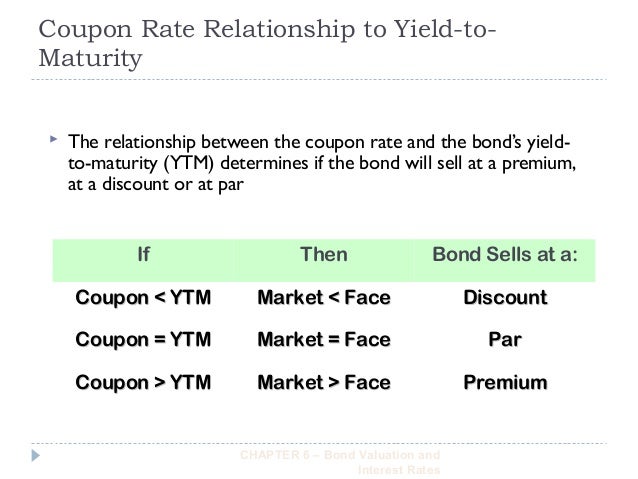

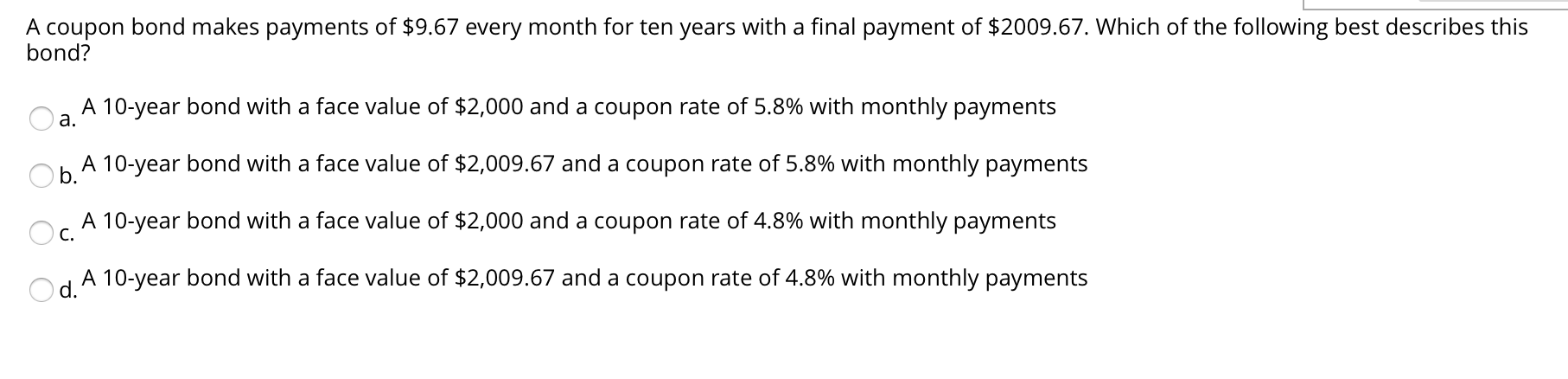

Solved What is the coupon rate for a bond with 3 years until - Chegg Finance questions and answers. What is the coupon rate for a bond with 3 years until maturity, a price of S 1,053.46, and a yield to maturity of 6%? ? 6% ? 8% 0 1096 O 11% If a bond is priced at par value, then: (Points: 4) 0 it has a very low level of default risk. O its coupon rate equals the market rate. O it must be a zero-coupon bond. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Finance Questions .pdf - 1. What is the coupon rate on a bond that has ... 33. Neither dividends nor capital gains are fixed or guaranteed. 34. A bond's coupon rate is the rate at which the bond's fixed cash flow, also referred to as its interest payment is used to calculate the investment's cash flows. 35. The coupon rate on a bond is the rate of interest used to calculate the coupon payment that is paid to the ...

What is the coupon rate of a bond. What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ... WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

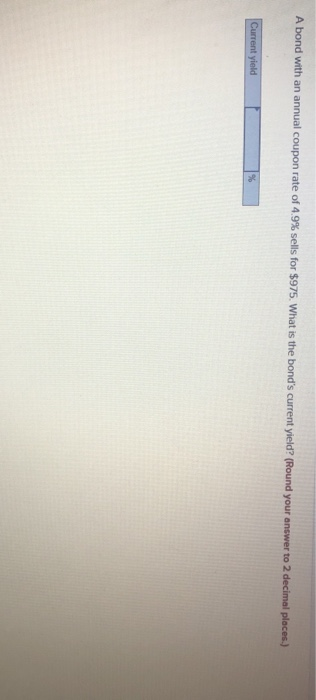

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. Solved: What is the coupon rate on a bond that has a par value of ... What is the coupon rate on a bond that has a par value of $1,000, a market value of $1,100, and a coupon interest rate of $100 per year? Step-by-step solution 100 % ( 13 ratings ) for this solution Solved 30) What is the real rate of interest? a) Inflation | Chegg.com Finance. Finance questions and answers. 30) What is the real rate of interest? a) Inflation b) Coupon rate you earn on a bond Capital yield less the dividend yield d) Interest rate less the inflation rate. e) 5% c) 31) What is it called when you identify an investment opportunity which is worth more to the business than it costs to acquire? What is coupon rate | Definition and Meaning | Capital.com Investors buying the bond on the secondary market, can get a higher return from the bond's interest payments, as they may be higher than the bond's coupon rate, giving the bond's yield to maturity. Coupon rate example. For example, a bond is issued with a par value of $1,000. It presupposes a coupon rate of 5 per cent and pays a total of ...

What Is a Coupon Rate? And How Does It Affects the Price of a Bond? To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50 Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond? Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

【How-to】How to Calculate Yield to Maturity - Howto.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%.

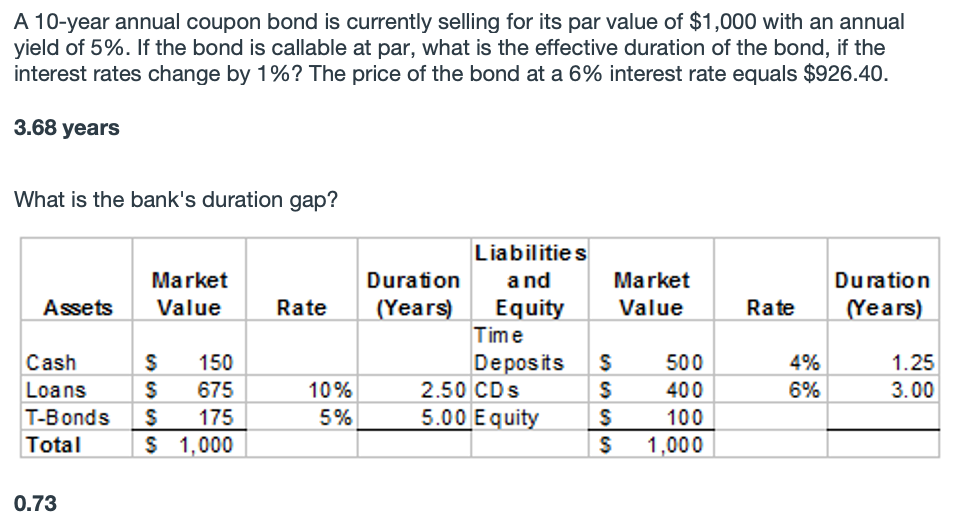

Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. Click here to learn more today.What does Coupon Rate mean?What is the difference between Coupon Rate and interest rate?

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Finance Questions .pdf - 1. What is the coupon rate on a bond that has ... 33. Neither dividends nor capital gains are fixed or guaranteed. 34. A bond's coupon rate is the rate at which the bond's fixed cash flow, also referred to as its interest payment is used to calculate the investment's cash flows. 35. The coupon rate on a bond is the rate of interest used to calculate the coupon payment that is paid to the ...

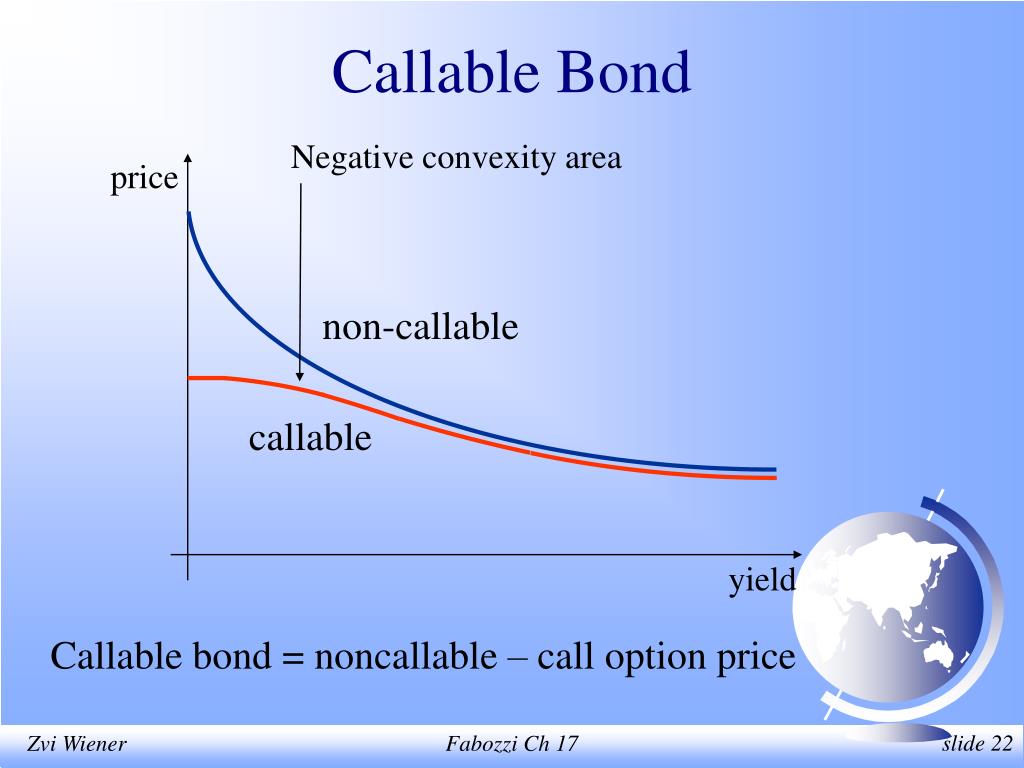

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Solved What is the coupon rate for a bond with 3 years until - Chegg Finance questions and answers. What is the coupon rate for a bond with 3 years until maturity, a price of S 1,053.46, and a yield to maturity of 6%? ? 6% ? 8% 0 1096 O 11% If a bond is priced at par value, then: (Points: 4) 0 it has a very low level of default risk. O its coupon rate equals the market rate. O it must be a zero-coupon bond.

Post a Comment for "43 what is the coupon rate of a bond"