45 a 10 year bond with a 9 annual coupon

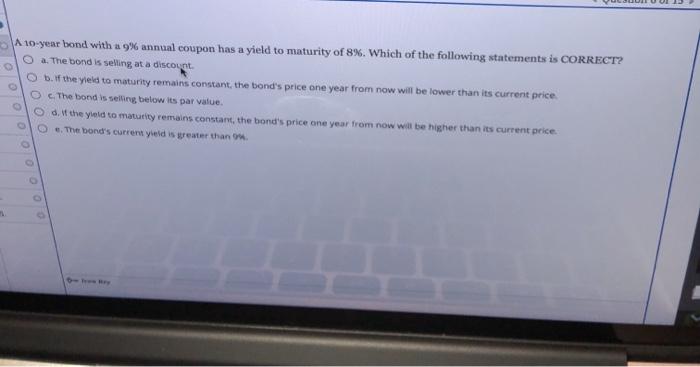

FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

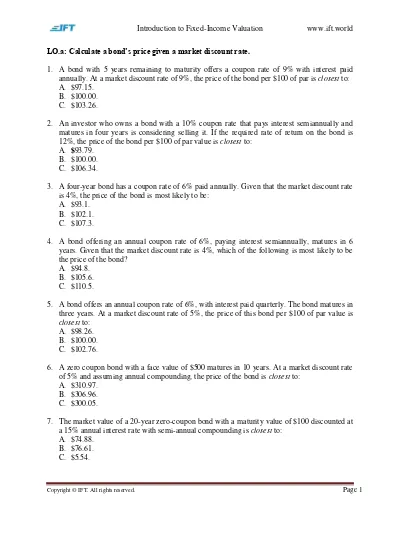

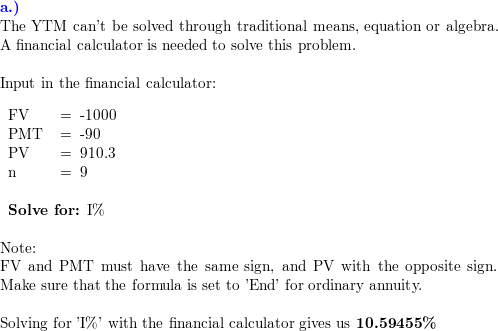

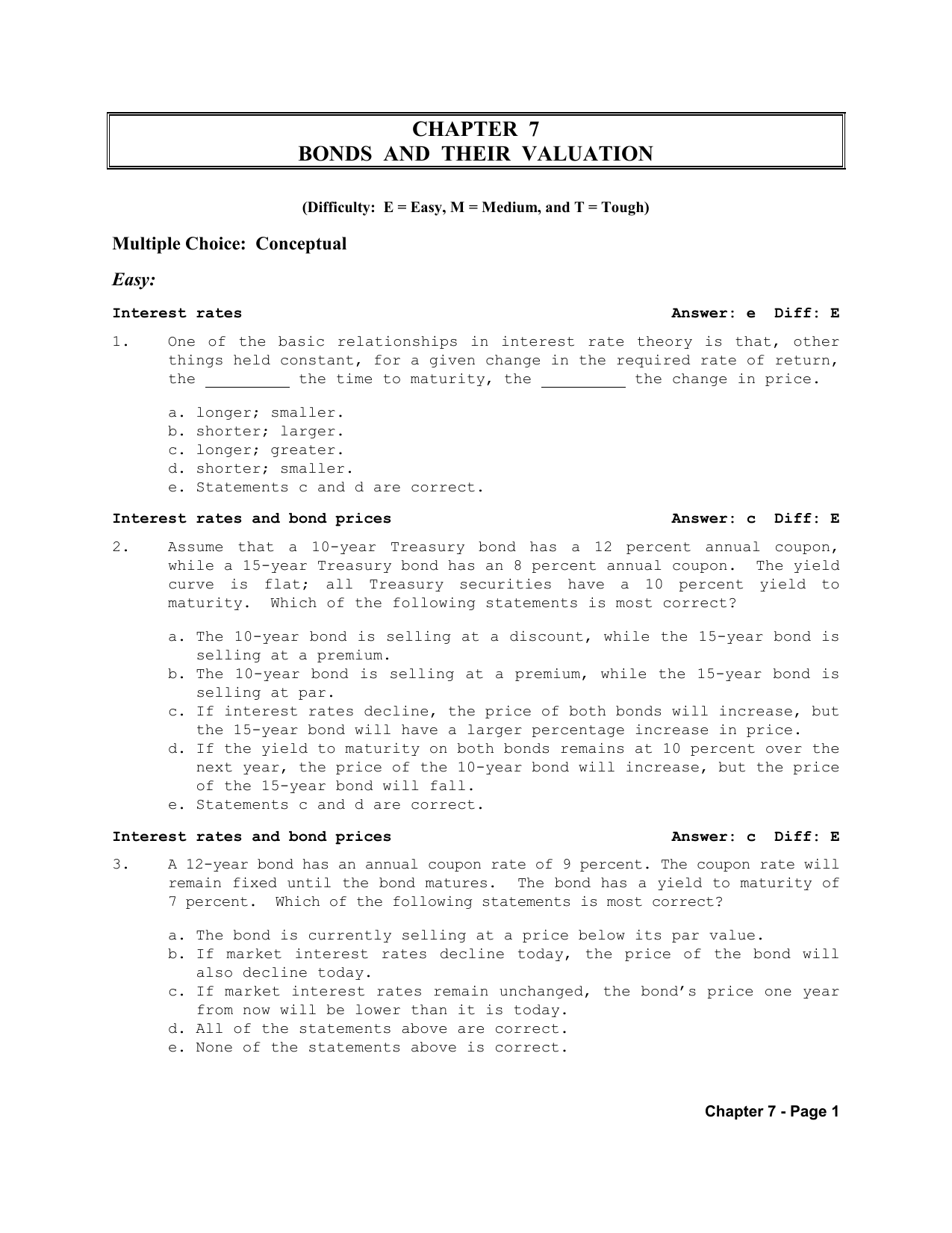

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... answered • expert verified A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

A 10 year bond with a 9 annual coupon

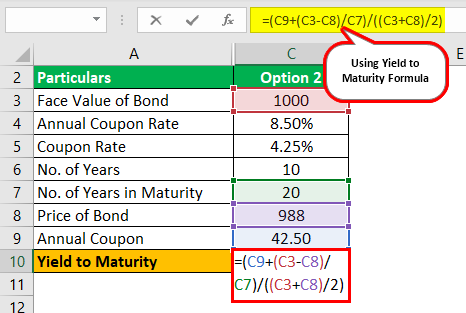

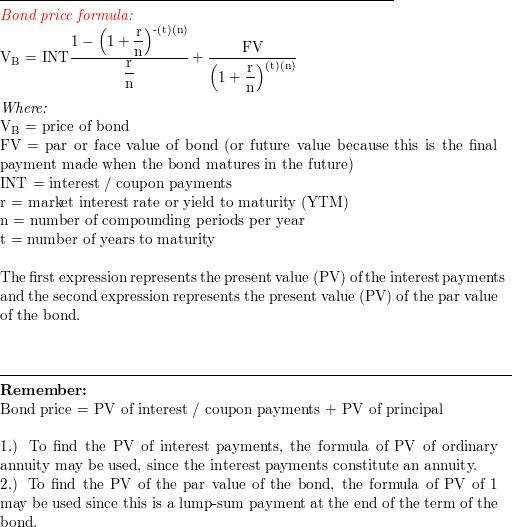

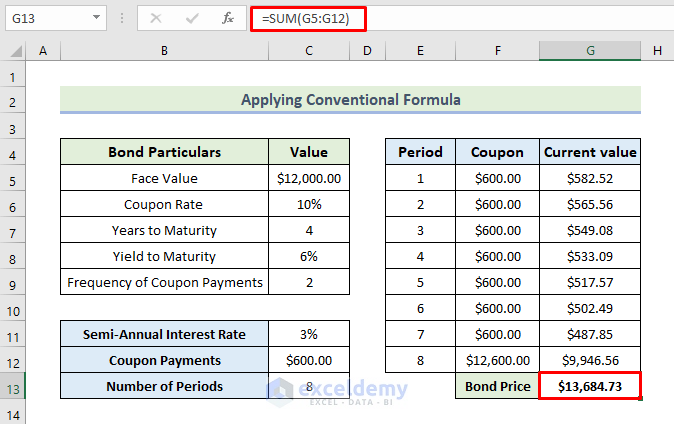

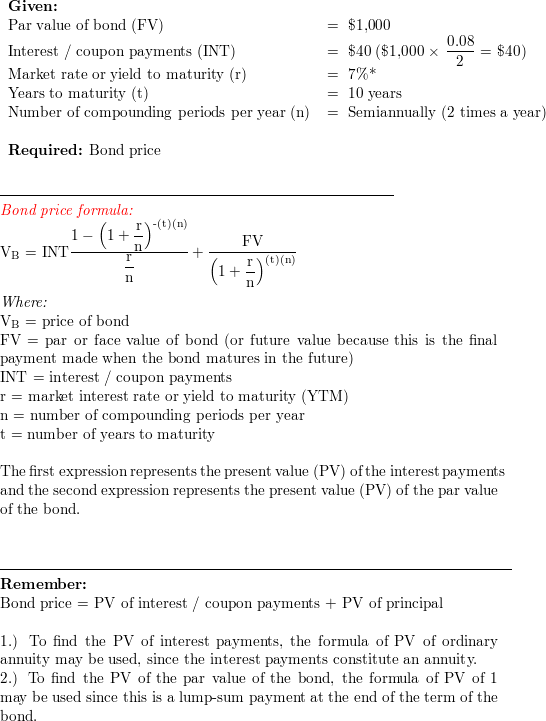

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Oct 17, 2022 · Ireland 10 Year Government Bond: 0.723: 2.814%: Belgium 10 Year Government Bond: 0.709: 2.922%: France 10 Year Government Bond: 0.814: 2.857%: Portugal 10 Year Government Bond: 0.636: 3.338% ...

A 10 year bond with a 9 annual coupon. Finance Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. The bond's current yield is greater than 9%. c. Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Group of answer choices If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond is selling at a discount. Yield To - unqzx.juweelzoetermeer.nl (Round to the nearest cent.) (Bond valuation) A bond that matures in 17 years has; Question: (Bond valuation)Calculate the value of a bond that matures in 11 years and has a$1,000 par value. The annual coupon interest rate is 13 percent and the market's required yield to maturity on a comparable-risk bond is 11. On this page is a bond duration ... Interest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ...

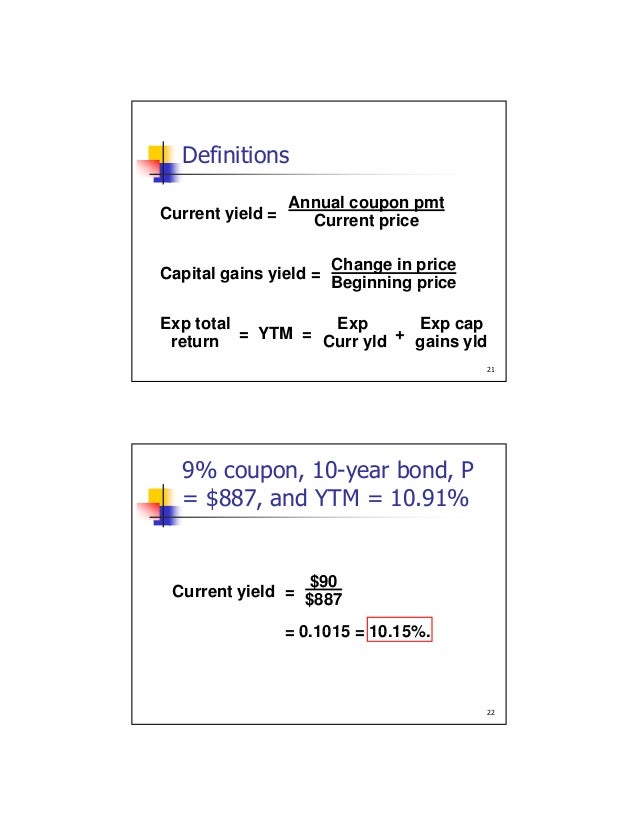

A 10 year corporate bond has an annual coupon of 9 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is INCORRECT? a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. The bond's current yield exceeds its capital gains yield. ANS: A a. A 10 year bond with a 9 annual coupon has a yield to A 10 year bond with a 9 annual coupon has a yield to maturity of 8 Which of the. A 10 year bond with a 9 annual coupon has a yield to. School RMU; Course Title FM 14; Type. Test Prep. Uploaded By masterparty. Pages 34 Ratings 98% (103) 101 out of 103 people found this document helpful; Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual coupon has a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current ...

Coupon Bond Formula | Examples with Excel Template - EDUCBA One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. ... It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically ... A 10-year bond with a 9% annual coupon has a yield to maturi A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a discount b. If the yield to maturity remains constant, the band's price one year from now will be lower than its current price c. The bond is selling below its par value. d. 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 17, 2022 is 4.02%. HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

iShares 10+ Year Investment Grade Corporate Bond ETF | IGLB Oct 18, 2022 · The iShares 10+ Year Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated investment-grade corporate bonds with remaining maturities greater than ten years. ... Average Annual; Cumulative; Calendar Year; as of 1y 3y 5y 10y Incept. ... Weighted Avg Coupon as of Oct 18, 2022 4. ...

Bidalot Coin Auction – Just another WordPress site Many advantages come with using a papers writing service.You get more time, a higher grade, a positive GPA, respect from fellow students and tutors, and flexibility in your college activities.

Archives - Los Angeles Times Nov 23, 2020 · You can also browse by year and month on our historical sitemap. Searching for printed articles and pages (1881 to the present) Readers can search printed pages and article clips going back to ...

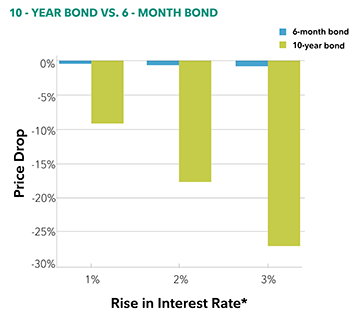

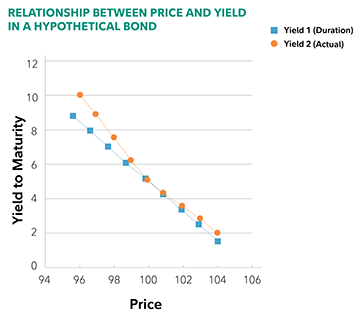

10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

Publication 550 (2021), Investment Income and Expenses You bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero.

A 10-year bond with a 9% annual coupon has a yield to...ask 5 - Quesba A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value. b. the bond is selling at a discount. c. the bond will earn a rate of return greater than 8%.

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved!

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Oct 17, 2022 · Ireland 10 Year Government Bond: 0.723: 2.814%: Belgium 10 Year Government Bond: 0.709: 2.922%: France 10 Year Government Bond: 0.814: 2.857%: Portugal 10 Year Government Bond: 0.636: 3.338% ...

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "45 a 10 year bond with a 9 annual coupon"