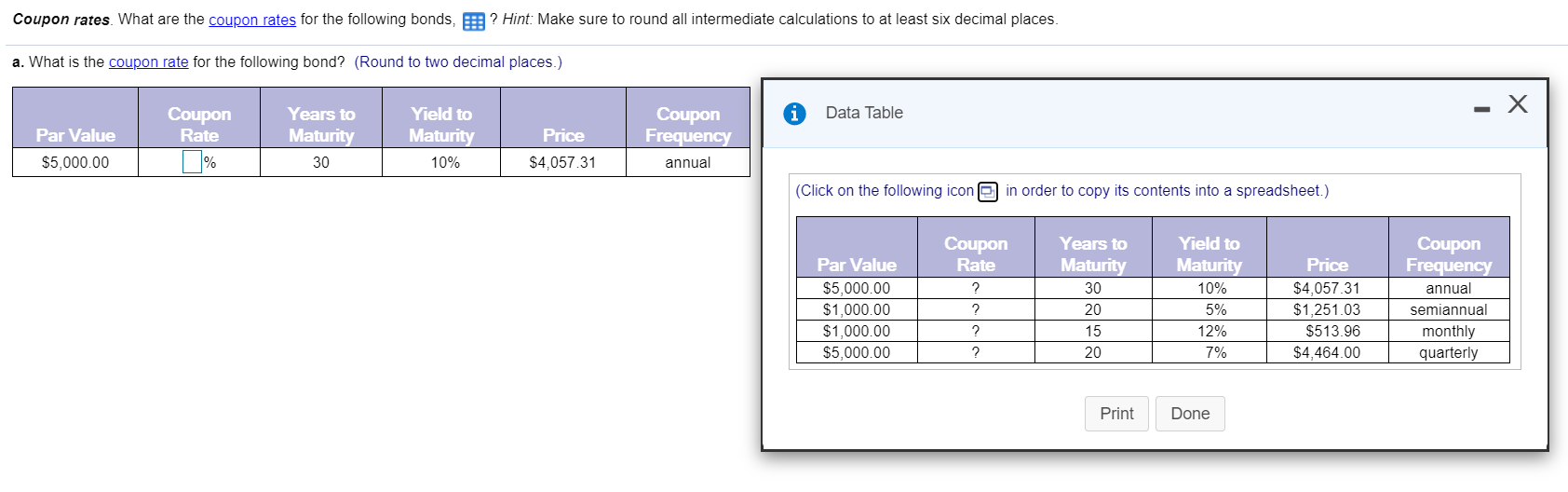

45 what are coupon rates

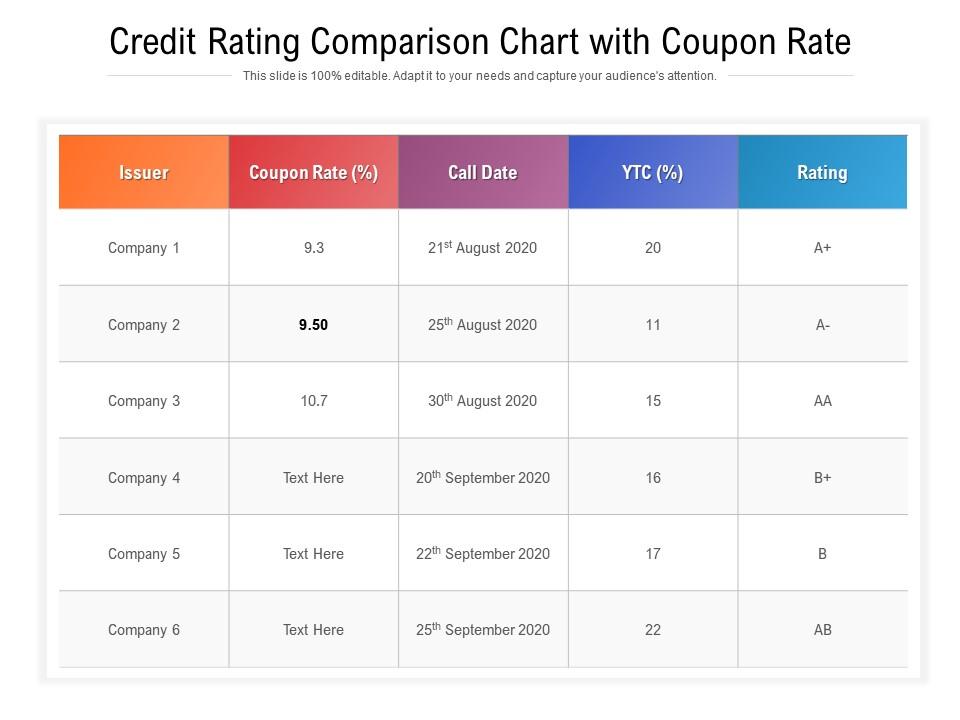

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Google Search the world's information, including webpages, images, videos and more. Google has many special features to help you find exactly what you're looking for.

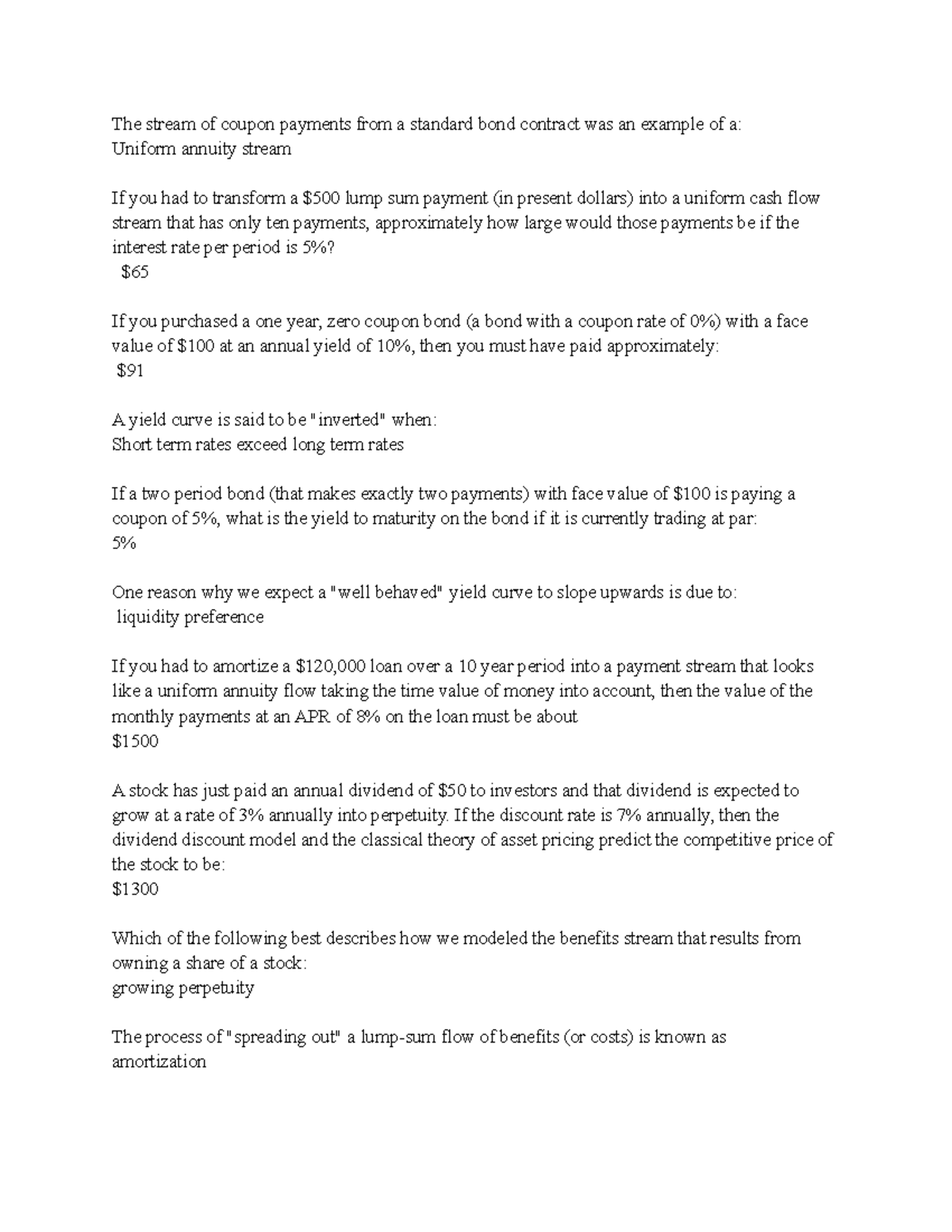

Zero-Coupon Bond: Definition, How It Works ... - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What are coupon rates

Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. That ... Stripe API reference – Create a subscription – curl Creates a new subscription on an existing customer. Each customer can have up to 500 active or scheduled subscriptions. When you create a subscription with collection_method=charge_automatically, the first invoice is finalized as part of the request. Loan Calculator Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds. After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors.

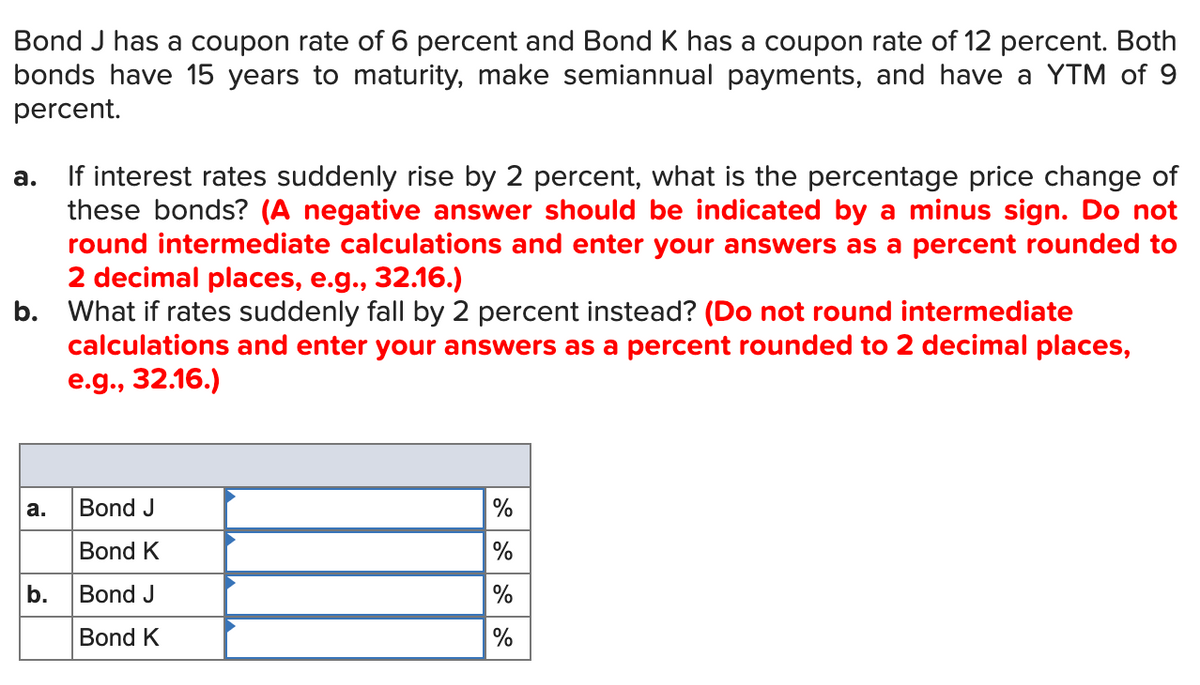

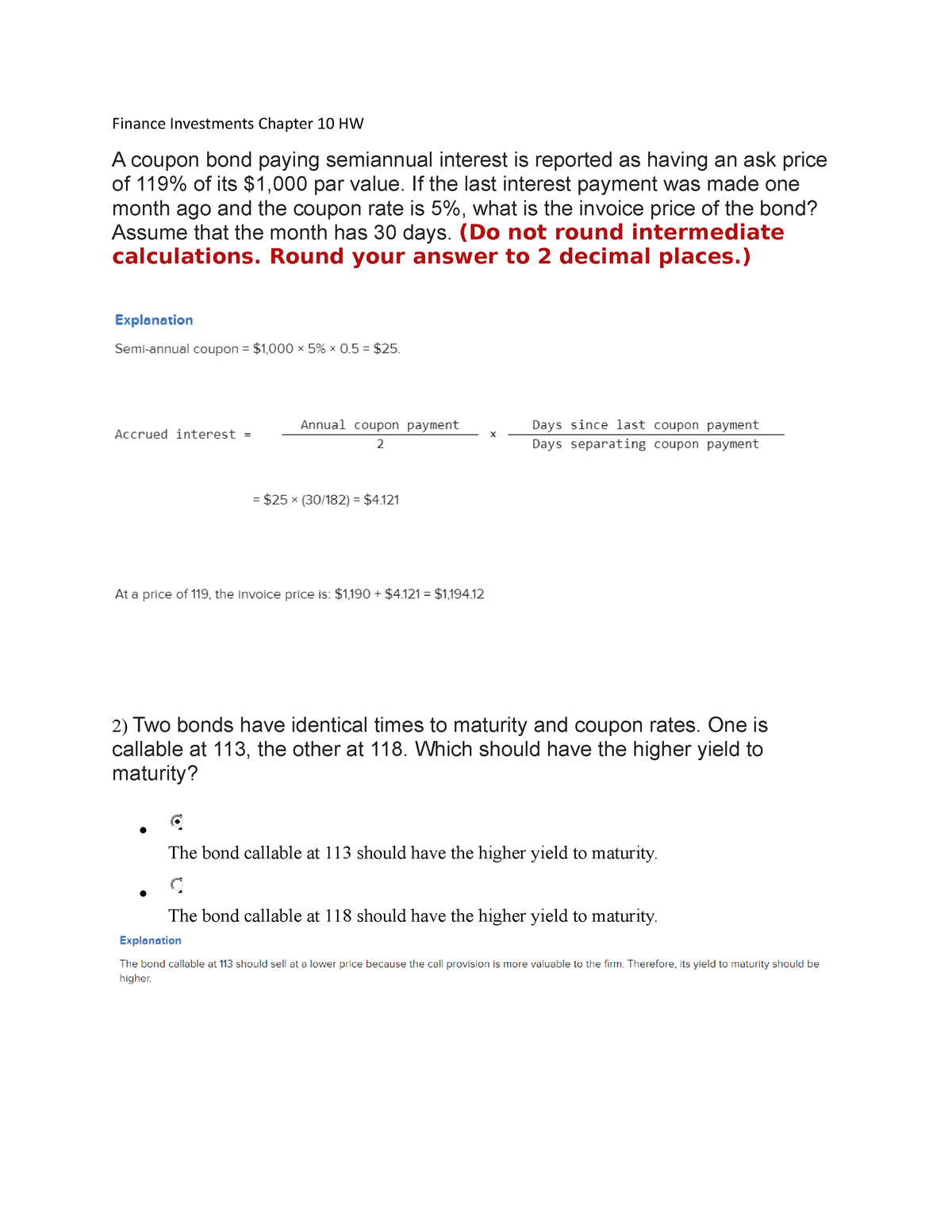

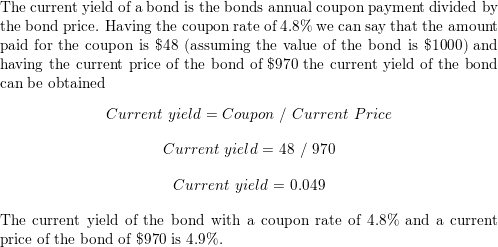

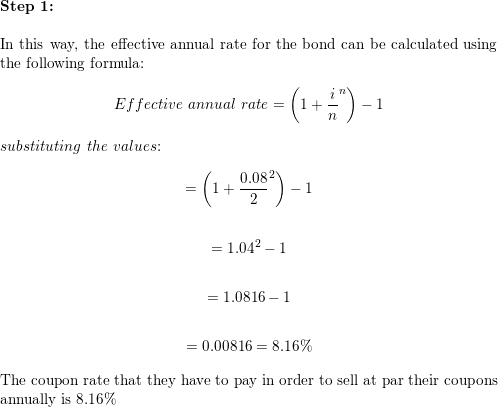

What are coupon rates. Bond duration - Wikipedia Consider a bond with a $1000 face value, 5% coupon rate and 6.5% annual yield, with maturity in 5 years. The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050. Loan Calculator Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds. After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. Stripe API reference – Create a subscription – curl Creates a new subscription on an existing customer. Each customer can have up to 500 active or scheduled subscriptions. When you create a subscription with collection_method=charge_automatically, the first invoice is finalized as part of the request. Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. That ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "45 what are coupon rates"